Essentials for Detecting a Digital Fraud Ring Attack on Your Business

What comes to mind when you imagine a fraud ring? Many people conjure images of hooded conspirators huddled together in a dark room who target corporations with money to spare. In reality, fraud rings can attack businesses and organizations of all sizes. It doesn’t matter if it’s a leading financial institution or an insuretech startup. Not only do these attacks change the numbers in a company’s ledger, but they cause real pain.

If you’re doing business online, you need to prepare to fend off fraud rings. Simply choosing the most affordable option and outsourcing this work won’t cut it. Growth-oriented business leaders should understand the real threats posed by fraud rings. That starts with knowing the best ways to protect their organizations. If you’re ready to dive in, read on and learn how to secure your business as it continues to grow.

The Dangers of a Fraud Ring Attack

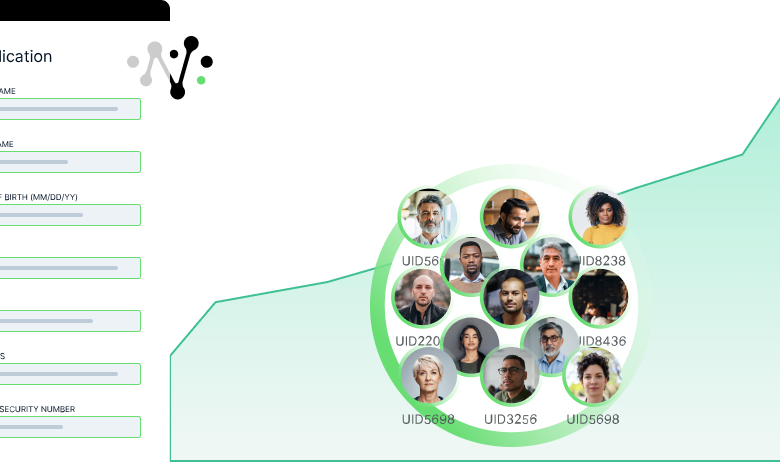

Essentially, a fraud ring is a group of fraudsters who pool their experience and resources. They take advantage of unsuspecting or inadequately protected organizations online. As a result, fraud rings pose unique threats to businesses in different industries. For example, a fraud ring might target an online lender. They could use a combination of stolen and synthetic identities to create dozens of accounts. Then, they max out the lines of credit and disappear. These attacks result in the loss of untold sums across many different sectors each year. Fraud rings depend on experience, coordination, and, of course, widely available compromised PII.

Why ID Verification Requires More Than PII

Identity verification systems that only look at submitted PII are at a disadvantage. In truth, it used to be much easier to establish a trustworthy digital identity. Details like a home address, phone number, and bank account information were more secure in years gone by. But then came countless hacks, data breaches, and phishing attempts. Now, troves of personally identifiable information are up for sale on the darknet.

Think of all this compromised PII as the kindling fraudsters need to build a bonfire. They can use a stolen identity to pose as a real person to thwart new account fraud detection systems. They can also selectively choose bits of PII from different profiles to craft synthetic identities. Stolen PII is easily accessed by these bad actors. So, savvy organizations are turning to more advanced means of identity verification.

Also Read: Tips for Medical Website Design

Stopping a Fraud Ring By Using Behavioral Analytics

To understand the best way to detect fraud activity, an analogy might be helpful. Imagine you’re a third-grade teacher, and your students are in the classroom completing an exam. However, you happen to be relaxing in the teachers’ lounge. When a student hands in their completed test, you have no way of knowing whether that student answered honestly. How can you tell if they cheated to come up with the right answers? If you were in the room with your students, you could easily see if students were sharing answers. It would be better still if you could look over each student’s shoulder to spot cheating. That’s what behavioral analytics tools do as users interact with your site’s membership application.

This groundbreaking technology examines more than just the answers themselves. It focuses on the way in which users input those answers. Say a user retypes their social security number three different times. This isn’t something a real person would typically do, right? Behavioral analytics software identifies that and other indicative behavior as risky activity. Then, it directs your step-up verification solutions to intervene. Best of all, the right tools monitor user activity at scale for real-time fraud ring detection.

About NeuroID

It’s a simple fact of doing business online: Bad actors are always sizing up digital defenses and devising new strategies for taking advantage of vulnerable organizations. Fraudsters develop increasingly sophisticated methods of posing as genuine customers to slip past old PII-based detection systems and target your company. But with the power of behavioral analytics tools from NeuroID, you can seize the initiative and detect fraud indicators before criminals have a chance to cheat you. The groundbreaking technology in their ID Crowd Alert™ and ID Orchestrator™ tools analyzes digital body language and pre-submit data to spot risky activity in real time. With the ability to detect fraud rapidly, your step-up verification systems can intervene and effectively protect your organization.

Get real-time fraud ring detection with innovative tools from NeuroID at https://www.neuro-id.com/